|

The interviews with the underwriter, subject matter expert, gives the rule

development team the following information:

-

The loan application contains information about the applicant (his name, his employment status, etc...) in a

special form called the 1003 form, also known as the Uniform Residential

Loan Application form.

-

The 1003 also contains information about the mortgage type that the applicant has selected (interest rate, term,

purpose, etc…) and about the property (property type, address, etc…).

-

The underwriter starts by looking at the 1003 to perform some basic verification on the application, such as

checking that the age of the primary applicant is at least 18, or that the primary applicant is a permanent US

resident. If any of these conditions is not met, the application is rejected.

-

If the application passes the initial validation, the underwriter then gathers the credit data for the primary

borrower and the co-borrower if there is one. This consists in retrieving the applicants detailed credit

information, such as details on their different lines of credits (e.g. credit cards, car loan, possible

bankruptcies) and their previous mortgage history (possible foreclosure and mortgage lates) from several external

services called credit bureaus. From the combined information, the underwriter calculates the value of different

parameters such as the credit score and the risk grade.

-

The company offers several loan programs relying on different risk criteria: ScoreTrust is the most popular program and relies on a combination of

credit score and mortgage lates grading.

-

The credit score considered by the company is the middle of the 3 score

provided by the credit agencies or the lower of the score if there is less than 2 reporting agencies available.

-

Then, the underwriter reviews the eligibility of the borrowers for the

selected loan program. The eligibility step is assessing:

-

The risk is taking in lending money to the applicants using in particular the credit score and the risk

grade determined from the credit information.

-

The validity of the loan with respect to certain state laws or to company specific guidelines.

-

The assessment will result in either accepting the application, referring it for further (manual) review, or

rejecting it:

-

If the risk is too big, the loan application will be referred for further review (e.g. the applicants may

be proposed another type of loan).

-

If the loan does not comply with the state guidelines or the company own guidelines, the

application will be rejected.

-

If the risk is acceptable and the request is conform to the eligibility guidelines, the loan request is

accepted and a corresponding LTV will be determined from LTV guides sheets for each program.

-

During the eligibility verification step, a set of stipulations and conditions messages (for example: "Cash-on-hand must be verified back to

the source.") are also collected and will be reported on the underwritten loan offer.

-

The next step is the pricing activity. The purpose of this step is to

determine the final rate of the loan, using the rate sheet for the selected loan program and applying different

adjustments based on property and applicant characteristics. It is important to record the breakdown of the pricing

(i.e. the value of base rate, the different adjustments, etc…) for audit purpose.

-

The pricing for a loan is determined using the appropriate loan program rate

sheets. These rate sheets are tables which give the base rate for a given credit score, risk grade and LTV

(Loan To Value). The rate sheets also define the different adjustments.

-

Once the loan is priced, the complete response (including the loan amount, the rate, stipulations and conditions)

goes to the Loan Origination System for closing.

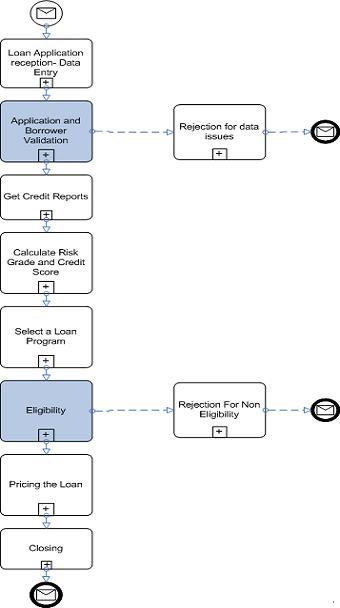

From these information we can draw a high level process map which will help us to

extract some decision points. We do not need to detail the tasks for the purpose of this sample.

From a first study we can see that there are a lot of decisions and expertise in the data validation and eligibility

steps, that for sure are important decision points to work on. So the discovery roadmap will be articulate to organize

workshops on those two steps. In fact the others steps like "Calculate Risk grade and credit score", "select loan

program", and "pricing" are also candidate for rules discovery, as risk management and pricing includes a lot of

exceptional policies a company may want to have the flexibility to change often to adapt to competition and market

changes. This loan application processing sample is following a simple business process, we will design using a process

map. So we will use a business process oriented discovery approach to model the loan application processing.

The decision points table may look like:

|

Decision

Point Name

|

Description

|

Source

for Rule Discovery

|

CurrentStateof

Automation

|

Rule

Owner -

SME

|

|

Data

validation

|

Validate the information entered around the borrower, the amount requested,

the property

|

1003 forms

Legal document per state and federal

|

Some rules are implemented in the current GUI used to enter the data In the

system

|

John

|

|

Calculate

Risk grade and credit score

|

calculates the value of different parameters such as the credit score and

the risk grade

|

Score cards

Excel files of the underwriter

|

none

|

Jack

|

|

Select a loan

program

|

Loan program can be defined as a set of conditions a borrower and the

property may need to respect.

|

Program definition and stipulation

|

none

|

Julie

|

|

Eligibility

|

Review the eligibility of the borrower for the selected loan

program

|

Underwriting policies

|

none

|

Paul

|

|

Pricing

|

Price the loan

|

Pricing list

Score cards

|

There is an existing application

|

Mary

|

|